A study of travel buyers on payment expense by BCD Travel highlighted that payment and expense is a growing priority for travel programs. Virtual cards and virtual payment are complex, which is why it’s important to understand what virtual business cards are and how they can help streamline travel and expense.

In this article we’ll break down virtual cards and VPAs and what that means for your business. Because after all, optimizing travel and expense is about ensuring you save money, limit the amount of work that goes into managing T&E, and help keep employees happy.

What is a VPA?

VPA, or Virtual Payment Automation, is a method of payment allowing for the provision of virtual, single-use credit cards for online payments. It’s considered to be more secure, as cards can be configured for the exact amount of the booking for a specific transaction. Virtual cards are provided by clients’ banks through a third-party payment provider like Conferma.

What is a virtual card and what are virtual payments?

Virtual cards are essentially digital versions of a physical credit card or a debit card. These credit or debit cards are linked to a bank account or credit card account. They can be used in your travel management app so as not to have to worry about reimbursements and for other online purchases or contactless transactions. A virtual card only exists digitally; it has no magnetic stripe or chip to process transactions like a physical card would.

Virtual payments are digital transactions that occur without using physical payment methods like cash or plastic cards. Instead, they use digital tools like virtual cards, digital wallets, and online payment systems. These payments provide secure, trackable, and often contactless ways to pay. Virtual payments can also help businesses control spending and simplify payment processing, as they can be integrated with accounting or expense management tools for streamlined tracking and reporting.

Virtual payments are made with a unique, randomly generated card number, expiration data and security code (CVV), which not only help avoid credit card fraud, but also make it easier to manage credit card access and control expenses.

Did you know?

Virtual cards are centrally billed, meaning that they are not assigned to cardholders individually but to your company as a whole. Your company is in charge of deciding who has rights to use these cards and how much to allocate to specific bookings and purchases.

How do virtual cards work to make travel arrangements?

Key features of virtual cards

Now let’s get a better understanding of the key features of virtual cards.

Centrally billed

Cards are not assigned to individuals but rather to your company as a whole. This lets you decide who can use the virtual card, define how the card should be used, and configure the card with other settings.

Control expenses more easily

VCCs can be restricted to specific travel bookings, and can even be set to specific amounts and limits, making it easier to control expenses. There can even be certain validity periods and currency types.This gives you better control of your travel spend because you can manage and track payments from the same account even if your company has multiple virtual card users.

Secure and flexible

Virtual credit card details are generated automatically and closed shortly after being used, so there is little risk of fraud. And when handling many different payments throughout the day, it makes the whole process easier and smoother for you and your team

How virtual cards can improve travel and expense (T&E) management

Virtual cards are a great way of streamlining the process of booking, tracking and controlling expenses. Let’s take a look at how this works.

1. Ease of expense tracking

By centralizing expense tracking, finance teams can better track transactions in real time. By dedicating a virtual card to specific employees, projects or departments, you can better control expenses, what was spent, where and for what purpose. This makes reconciliation and auditing for the whole finance team easier.

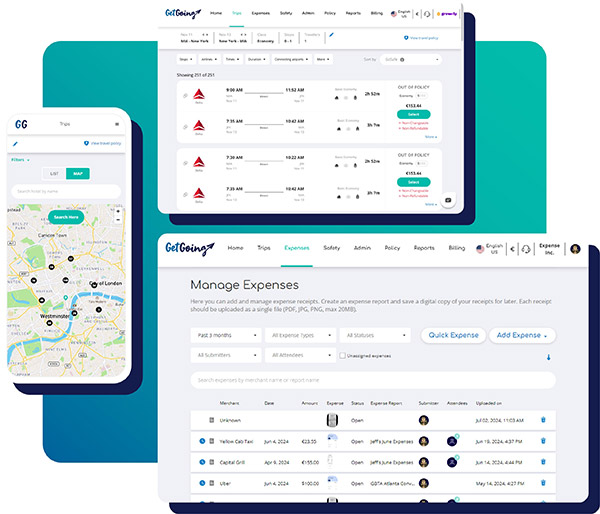

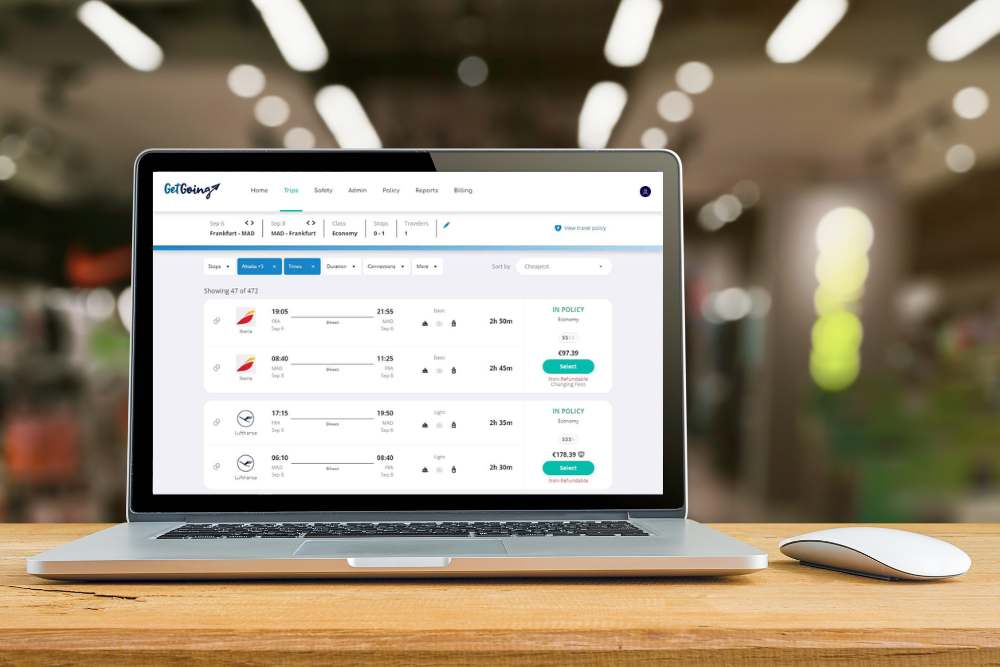

2. Integration with T&E software

Many virtual cards can be integrated with your T&E software, which allows expense data to easily be imported from virtual cards to your expense management platform. This allows finance controllers and finance teams in general to easily get insights for financial reporting on spending trends, and patterns. This means that payments can easily be handled with central billing.

3. Faster reimbursement and reduced administrative work

Virtual cards can also help your company remove the extra step of reimbursing travel and business expenses because employees no longer need to make expense claims seeing as VCCs are linked to company accounts and not personal accounts. This helps make accounting and approvals easy while minimizing approval processes, and administrative work around expense reimbursements thanks to automation.

4. Better control

When someone needs to book travel or purchase something for work, companies can issue virtual cards with pre-set limits, allowing companies to closely control and monitor their spend. This also helps companies control how much is spent on specific trips and purchases, and avoids overspending.

5. Simplified travel management

Virtual cards can simplify travel booking management, allowing you to access bookings, create a smooth payment flow, and drive efficiency and savings.

6. Employee satisfaction

Not only will your finance teams be happier with a more streamlined way to manage employee travel spend and expenses, but travelers and other employees will feel the satisfaction of less time spent on expenses and more time on the work that really matters.With virtual payments, say goodbye to expense claims and give time back to your already busy employees.

Why should your company opt for a virtual business card?

Virtual business cards are incredibly practical because they simplify control, boost security, and provide visibility on company spend in real-time, making it both efficient for employees and finance teams.

If you’re ready to start using VPA on GetGoing or curious about how to get started,